What is Quick Commerce?

Quick commerce is the next stage of eCommerce and is all about speedy delivery ( within less than an hour) of products and services to consumers. While eCommerce revolutionized traditional retail, the average delivery time still ranges from 3 to 5 days, and big orders are often encouraged. Quick commerce goes a step further to deliver small orders almost instantly, whenever and wherever consumers need them. It encourages shopping on-demand rather than shopping for a big list at one go – a trend that is fast catching on, especially in the food and grocery industry.

Quick commerce or Q-commerce first gained momentum amidst the peak of COVID when large-format retailers and new-age start-ups bolstered their supply chain and fulfillment processes to enable same-day delivery or even 1-2 hours delivery. Examples: Doordash, Postmates, Delivery Hero, Instacart, etc. According to a Coresight Research report, “The quick commerce retail space was primed to generate between $20 billion to $25 billion in U.S. retail sales last year. This growth number is expected to reach $75 billion in 2025.”

How does Quick Commerce Operate?

Unlike large warehouses based on the outskirts of cities to fulfill eCommerce orders, quick commerce leverages small fulfillment centers at multiple locations in the city to deliver orders fast. The success of quick commerce relies largely on robust warehousing and delivery partners, advanced online ordering systems, the right product assortments, and quick delivery turnaround times. In this retail format, businesses usually keep limited, high-demand inventory in their warehouses which can be quickly dispatched to nearby areas as soon as orders are placed.

Key Differentiation of Different Retail Models

Popular Quick Commerce Categories

The Rise in Quick Commerce in the Post-Pandemic Era

Consumer preferences have changed immensely over the last few years. Urbanization, smaller households, busier lifestyles, and aging populations have led to an increase in the need for quicker, more convenient shopping options. Instead of buying groceries and household goods in bulk – a basis for traditional retail and eCommerce, shoppers now prefer shopping for smaller ticket items and fewer goods in real-time as and when they need them. This behavior gave rise to Q-Commerce, where even 1-2 products could be delivered to individuals in minutes of placing the order. And as the adoption of quick commerce is growing, consumers’ willingness to wait for 3-5 days to get their deliveries has started to decline, making way for quick commerce as a retail segment of its own. In fact, these instant delivery platforms attracted over $14 billion in funding last year.

And while quick commerce was already in existence and used extensively for takeaway food delivery, it caught on rapidly in other segments as well during the pandemic. Especially the grocery segment. As consumers had to rely on online shopping amidst country-wide curfews and lockdowns, large-format players like Walmart and Tesco saw an opportunity. They bolstered their delivery services to provide fast grocery delivery in many areas. As this trend caught on, many instant delivery players like DoorDash, Deliveroo, GoPuff, and Postmates exploded in the grocery delivery space, a market less explored pre-covid.

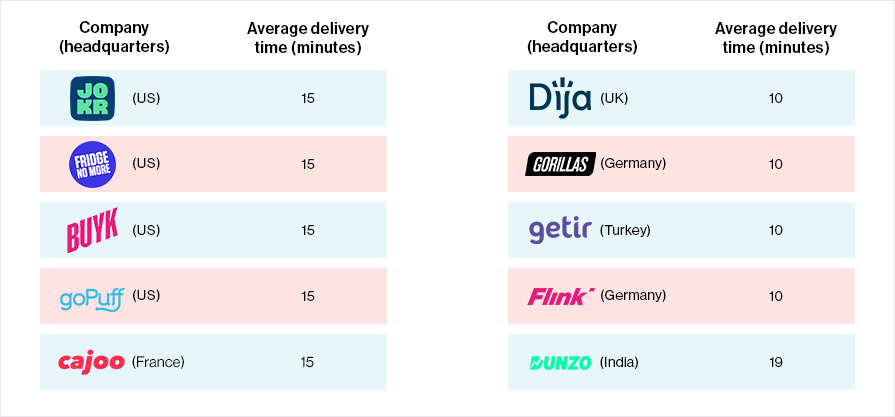

The Race to the Fastest Delivery Time, 2022

With competition intensifying in the quick commerce segment, businesses are fighting over the same shoppers to expand their market share. Offering faster delivery than competitors is one of the key areas businesses are focusing on in order to improve the consumer experience, loyalty, and get a competitive edge. UK-based Dija, Germany-based Gorillas, Getir of Turkey, and Flink, Germany are leading the delivery game by offering 10-minute deliveries to their consumers.

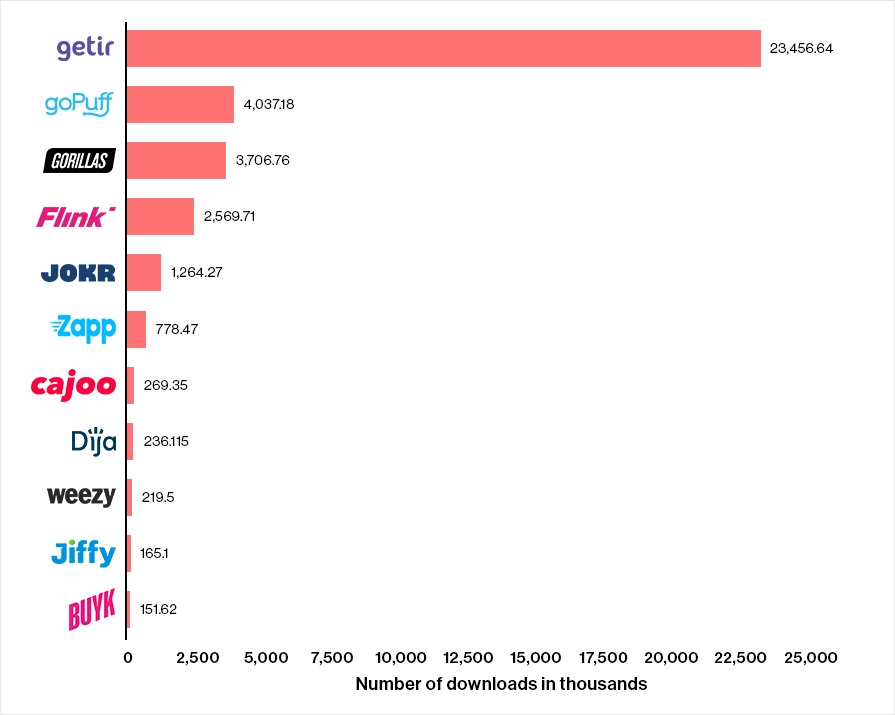

Number of Downloads for Top Quick Commerce Apps, 2021

Quick commerce demand exploded amidst the pandemic and continues to see growth even in the post-pandemic era, with consumers getting used to the convenience and speed of this service. According to Statista, Getir, a Turkey-based instant delivery app saw the maximum number of downloads in 2021 with over 23 million people downloading the app that year. US-based GoPuff saw the next largest downloads of over 4 million, while Gorillas (Germany) received over 3.7 million downloads.

Quick Commerce Challenges

Although quick commerce is making waves globally and is getting adopted rapidly by digital-first shoppers, it is not without its challenges. Quick commerce’s promise of lightning-fast delivery means this business model needs a robust supply chain, the right inventory, reliable delivery, and excellent customer service. Some of the challenges that Q-Commerce businesses face today are:

- Addressing fierce competition

- Offering faster delivery fulfillment

- Ensuring environmental viability

- Building reliable delivery solutions

- Offering elevated, personalized customer service

- Optimizing delivery costs

- Offering the right product assortment

- Ensuring product availability

Best Practices for Successful Quick Commerce Implementation

1. Offer competitive prices

Pricing is key to attracting and converting today’s comparison shoppers and applies to quick commerce as well. While shoppers want the convenience of fast deliveries, it is often not at the cost of spending more money. In a recent consumer survey, Coresight found that people who buy groceries for same-day or faster delivery said low or no delivery fees and the price of items are the most important factors to them (60.6% and 53.4%, respectively).

This data shows the importance of competitive pricing in ensuring conversions and brand loyalty. And to offer competitive pricing, businesses need to have visibility into their competitors’ prices at the zip code level. They need to compare against prices and delivery charges offered by competitors in the specific areas they are selling in, at specific times of the day (peak order times vs non-peak order times, etc.), and for particular distances. Businesses can get access to this data in real-time with the help of AI-driven, advanced pricing solutions that are accurate, fast, and easy to operate.

2. Set up robust local fulfillment hubs

For quick commerce or instant delivery platforms to work, they need to have decentralized warehouses set up across different city areas. Delivering orders within an hour amidst peak traffic hours, roadblocks, and last-minute order changes necessitates the warehouses to be located in multiple locations with easy access to different parts of the cities they operate in. Setting up local fulfillment hubs, finding the right delivery partners, and supply chain solutions will go a long way in ensuring long-term growth and profitability.

3. Offer the right assortment and ensure product availability

Q-commerce businesses need to display the right assortment at the right time to attract the right audiences. They need to analyze the best-selling products in different areas and stock up on them to prevent stockouts. Out-of-stocks can discourage consumers from repeating a purchase and can lead to dissatisfied shoppers. Analyzing shopper trends, in-demand products, and competitor assortment in certain zip codes is another way to stock up on the right items. Advanced assortment analytics solutions can help identify assortment gaps, track top-selling products, analyze key assortment metrics for data-driven decision making, and order for the right inventory at all times.

4. Leverage demand forecasting

In the Q-Commerce business model, businesses don’t stock up on a wide assortment but only on limited, fast-moving assortment. It hence becomes important to forecast demand accurately and accordingly stock up on products. Many instant delivery SKUs are food items with a limited shelf life so it is essential to not over-stock on products that might not sell. Similarly, running out of stock with limited inventory is not an option as it will lead to consumer dissatisfaction. Leveraging an advanced forecasting tool and data analytics that forecast demand based on sales velocity, historical data, and consumer buying habits across different zipcodes can help retailers make the right purchase decisions.

5. Offer personalized consumer experience

With all instant delivery platforms offering a similar assortment, it becomes important for businesses to stand out another way – by offering a personalized consumer experience. Retailers need to track consumer buying behavior to offer customized offers, discounts, and deals that make shoppers feel valuable. By analyzing consumer buying trends, these platforms can also promote products preferred by shoppers and build better relationships with them for long-term retention and brand loyalty.

Final Word: Navigating the Future of Retail with Q-Commerce

Today’s consumers are increasingly impatient and prefer faster, more efficient ways of shopping. While eCommerce has evolved from one-week delivery timelines to 1-2 days delivery, Q-Commerce is taking shopping to a whole new level by delivering small orders in minutes. As more consumers get used to this mode of shopping, there are chances that more categories like pet supplies, fashion, consumer electronics, and accessories enter this market. With Millennials and Gen Z shoppers fast adopting newer, convenient ways of shopping, we could be looking at quick commerce becoming the next big thing in retail. But it is important to remember that businesses need to navigate significant hurdles to thrive in this ultra-competitive retail space. The constraints around consumer willingness to pay more and the added costs and logistics burden can make it challenging to attain profitability and longevity in this business in the absence of the right technology, consumer centricity, and flexibility.